We plan for your goals, Invest in right products, and track them based on market conditions to achieve your goals

3 Simple Steps to Do it

Plan Your Goals

A personalised Financial Plan for your life goals.

Invest Smartly

Investment management based on your risk profile and goals.

Track and Re-balance

Constant tracking and re-balancing based on market conditions.

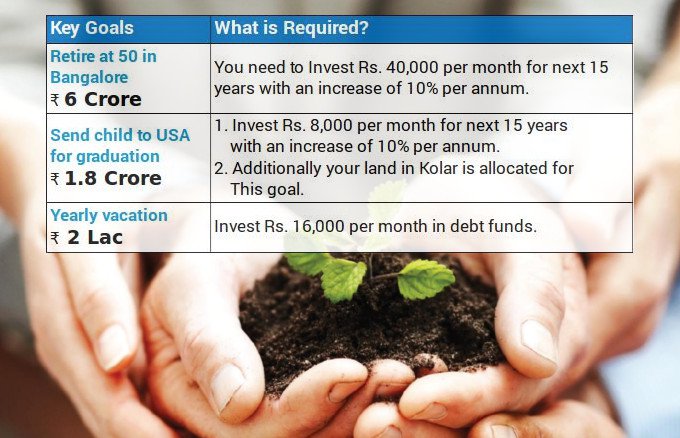

Plan your goals

Goals: We spend time to understand your needs and aspirations and prepare a financial plan to achieve them.

Protect: We help you to prepare yourself if things go wrong financially. We identify what insurance is required to protect yourself and your family.

Asset Allocation: We arrive at the right asset allocation for you based on your risk profile and life stage. We even chalk out a plan for you to move from current to the recommended asset allocation.

Tax & Estate planning: We provide advice on better tax efficient products so that you can invest smartly. We come up with Estate plan for wealth distribution to your future generation.

Invest Smartly

Investment execution based on your identified goals and risk profile.

Invest smartly in multiple asset classes like Equities, Debt and Gold based on market cycles. This is done based on our proprietary investment model called ATM .

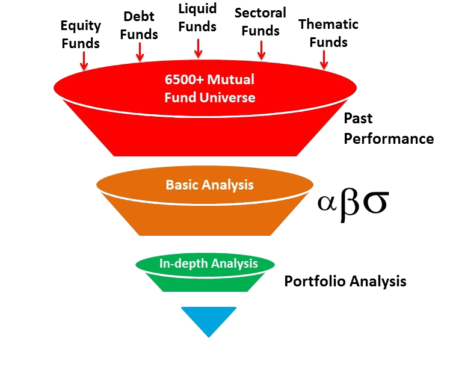

Rigorous product selection process For each of the asset class, ArhaumEnterprises research team uses cutting edge tools and rigorous process to identify best investment products suitable for your needs.

Consolidated view Facility to consolidate your existing investments on our online portal.

Track and Re-balance

Continuous tracking of your investments.

- Arhaum Enterprises Timing Model (ATM).

- Based on your goals (when a particular goal gets near, increase allocation of debt based instruments for that goal irrespective of market conditions).

Re-balance your portfolio based on:

Review your financial plan at least once a year.